COVID-19 . . . It was expected to create turmoil in the credit markets and especially decimate subprime lending, which serves the most economically vulnerable consumers. However, we heard almost as much of the term “resiliency” to describe everything and everyone who has endured, or even thrived, in the past year. It also aptly describes subprime auto lending and securitization, which have performed much better than expected throughout the pandemic.

Subprime Auto: Participants’ Expectations Moving on From 2020

June 2021 Update

360° Market Study of Subprime Auto Participants

Highlights of the report include:

- While there is still a high level of negativity (73%), it is lower than last year (81%), reflecting growing confidence that we are nearing the end of uncertain times.

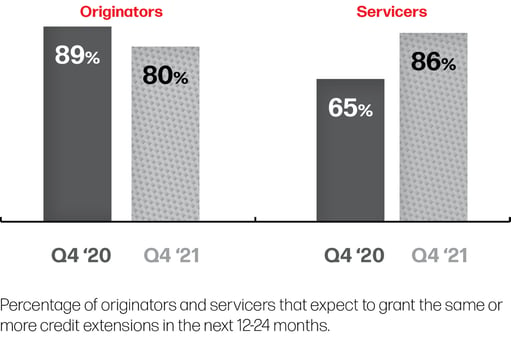

- Given continued uncertainty, originators and servicers expect to grant the same or more credit extensions in the next 12-24 months.

- Despite record unemployment during the pandemic, subprime auto lending and securitization have been boosted by an extraordinary combination of events, including unprecedented government stimulus, credit extensions and low vehicle supply contributing to strong resale values.