The COVID-19 pandemic has jeopardized the financial security of many Americans, especially subprime borrowers, many of whom work in fragile industries and hold vulnerable positions. Unemployment, a key indicator of loan performance, has reached the highest levels since the Great Depression. Yet, during this economic crisis, subprime auto securitizations have continued to roll to market.

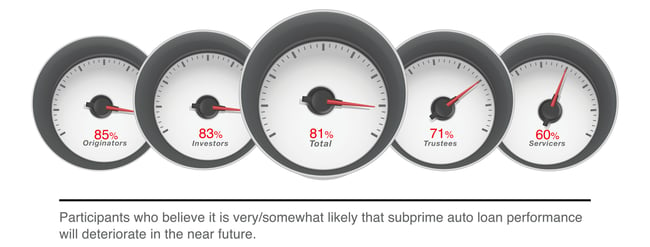

With the worst economic recession of our lifetime as a real possibility, we reopened our survey to compare market sentiment in this Covid-era to our results from 2019 and our pre-Covid 2020 survey that we closed in early March. The study that follows is the result of broad participation from over 100 market participants of all types, including originators, investors, trustees, servicers and others in the field.

.jpeg?width=650&name=Images%20for%20B+B2%20(Cropped).jpeg)