Due to the extraordinary impact of the coronavirus and the unprecedented stimulus programs to grant consumer relief and provide liquidity to the markets, we went back to subprime auto market participants to compare market sentiment from the start of the pandemic versus where we stand today. We again gathered input from originators, investors, servicers, trustees and advisors to compare how the findings from our Second Annual Market Study have changed and our latest Q4 Update details what we found.

Participants' Expectations in a Time of Crisis

Q4 Update

360° Market Study of Subprime Auto Participants | December 2020

Highlights of the report include:

- There is consensus in the market regarding the importance of relief programs and negative expectations for loan performance.

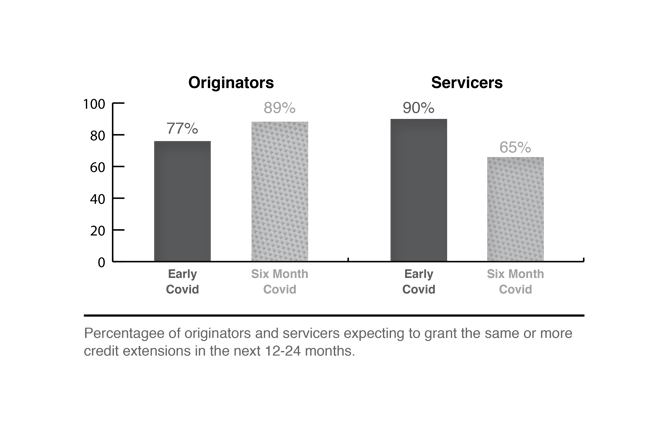

- Six months into the crisis, despite negative performance expectations, a key group expects to grant far fewer extensions than they did in the early days of the pandemic.

- Participants continue to expect the pandemic to have a long-term impact on their desire to participate in securitizations and one group in particular is especially concerned they will incur losses due to consumer relief programs.